Operating income, also known as income from operations, is a measure of a company’s profit that is generated from its core business activities. It excludes income or losses that are generated from investments and other non-core activities. Operating income can be used to assess the overall financial health of a company and to make comparisons between companies.

There are two main components of operating income: revenue and expenses. Revenue is the amount of money that a company earns through its sales and services. Expenses are the costs associated with generating that revenue, such as wages, materials, and rent.

The calculation for operating income is simple: revenue minus expenses. This gives you the profit that the company earned from its core activities. However, it’s important to note that not all expenses are included in this calculation. Only those expenses that are directly related to generating revenue are included.

Formula for Operating income

Operating income is a business’s profit after deducting the costs associated with making and selling its products, such as cost of goods sold and operating expenses. This figure can be found on a company’s income statement. To calculate it, simply subtract total operating expenses from total revenue.

While net income is an important measure of a company’s overall profitability, it doesn’t tell the whole story. That’s because net income includes items such as interest payments and taxes, which aren’t related to the day-to-day operations of a business. By contrast, operating income measures the profits generated by a company’s core operations.

It can be helpful to look at operating income as a percentage of revenue. This gives you an idea of how efficiently a company is generating profits from its sales. The higher the percentage, the better.

Operating Income = Gross Income − Operating Expenses

How to Calculate Operating Income

Calculating your company’s operating income is a critical step in understanding its financial health. Operating income reflects the profits generated by a company’s normal, core operations, and can be used to measure its overall performance. There are a few different ways to calculate operating income, but each method will give you an idea of how well your company is doing relative to its past performance and industry averages.

One common way to calculate operating income is to subtract total expenses from total revenue. This will give you the company’s net operating income. You can also calculate operating income margin by dividing net operating income by total revenue. This metric measures how efficiently a company is using its resources to generate profits. Operating income can also be calculated on a per-share basis, which takes into account the number of shares outstanding.

What are Revenue and Gross Profit?

Revenue and Gross Profit are two important financial metrics that business owners and investors use to measure a company’s financial health. Revenue is the total amount of money a company brings in from its sales of goods or services. Gross profit is the amount of revenue left over after a company subtracts the cost of goods sold from its total revenue.

Both revenue and gross profit are important indicators of a company’s financial health. A high revenue number means that a company is selling a lot of products or services, while a high gross profit number means that the company is making good profits on those sales. Investors and business owners use these numbers to make decisions about whether to invest in or buy a company.

Operating Income = EBIT

Operating income, or EBIT, is a key measure of a company’s overall financial performance. It is calculated by subtracting total operating expenses from total revenue. This metric gives investors a sense of how much money the company is making from its core operations.

EBIT can be used to assess a company’s profitability and liquidity. It is also a key indicator of whether or not a business is generating enough cash flow to cover its operating costs.

EBIT can be compared to other financial metrics, such as net income and earnings per share, to get a more complete picture of a company’s performance. Investors should pay close attention to EBIT as it can provide insights into a company’s health and prospects for future growth.

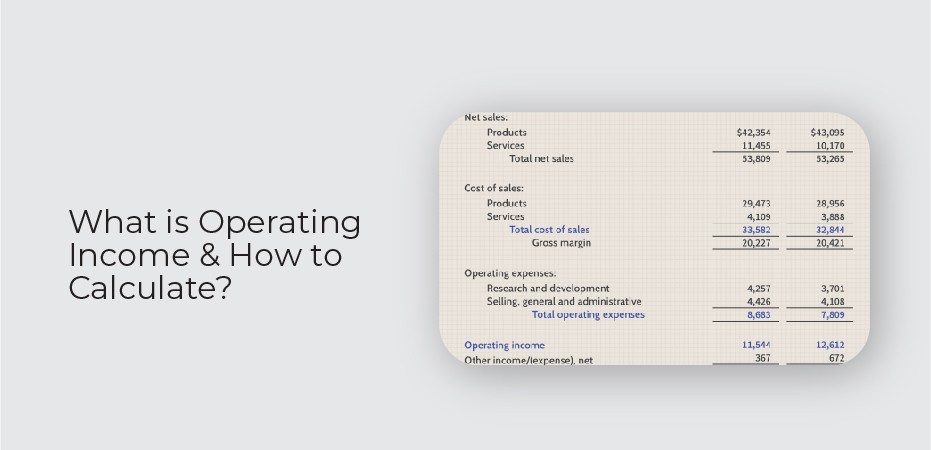

Real-Life Example of Revenue and Operating Income

In order to understand a company’s revenue and operating income, it is important to look at a real-life example. For the past three years, ABC Company has generated the following revenue and operating income (in millions of dollars):

This information can be found on ABC Company’s 10-K filings. From this data, we can see that ABC Company’s revenue has been steadily increasing from $846 million in 2014 to $952 million in 2016. However, their operating income has been somewhat volatile, ranging from a loss of $2 million in 2014 to a profit of $24 million in 2016.