How to calculate EBIT? Earnings before interest and taxes (EBIT) is an important measure of financial performance. It’s calculated by subtracting a company’s operating expenses from its operating income.

This figure tells you how much money a company has left over after paying for the costs of doing business. EBIT can be used to gauge a company’s profitability and cash flow. It’s also helpful for comparing different businesses, since it removes the impact of different tax rates.

Formula for Earnings Before Interest and Taxes (EBIT)

The formula for Earnings Before Interest and Taxes (EBIT) is:

EBIT = Net Income + Interest Expense – Tax Expense

This equation calculates a company’s profits before any deductions are made for interest or taxes. This metric is important because it measures a company’s ability to generate profits without the assistance of outside factors. It can also be used to compare companies with different levels of debt.

How to Calculate EBIT (Earnings Before Interest and Taxes)

When calculating a company’s earnings, it’s important to know how much of that number is due to profit and how much is due to other sources of income. One way to measure this is by calculating a company’s earnings before interest and taxes (EBIT). This metric removes the effects of financing and taxation from a company’s net income, providing a more accurate view of its profitability.

There are several ways to calculate EBIT. One common method is to use the following formula:

EBIT = Revenue – Operating Expenses – Interest Expenses

This equation takes into account a company’s revenue, operating expenses, and interest expenses. It can help business owners and investors better understand a company’s financial standing and performance.

EBIT and Taxes

Income before interest and taxes (EBIT) is a company’s earnings before taking into account interest payments and income taxes. This metric is used to measure a company’s profitability.

When calculating EBIT, a company’s total revenue is first divided by the total expenses, including interest payments and income taxes. This calculation gives us the company’s net operating income. The next step is to subtract interest payments from this figure. Finally, we subtract income taxes to arrive at EBIT.

Many investors use EBIT as a way to measure a company’s ability to generate cash flow. Because interest payments are fixed, they are less affected by changes in a company’s sales volume than other costs such as wages or raw materials. Income taxes are also important because they can vary greatly from one year to the next, depending on how much profit the company makes.

EBIT and Debt

EBIT, or Earnings Before Interest and Taxes, is a metric used to measure a company’s profitability. This number is calculated by taking a company’s total revenue and subtracting the cost of goods sold and the operating expenses. This metric is important because it shows how much money a company has left over after paying for the costs of doing business. A high EBIT indicates that a company is performing well and is in a good position to pay its debts.

A company’s debt-to-EBIT ratio can be used to measure its financial health. This ratio is calculated by dividing a company’s total debt by its EBIT. This number tells you how long it would take a company to pay off its debt if it used all of its profits to do so.

EBIT Applications

EBIT applications are found in a variety of industries. In the early days of business, accountants used earnings before interest and taxes (EBIT) as a way to measure a company’s profitability.

Today, EBIT is still used as a measure of profitability, but it is also used as a tool for decision-making and analysis in a number of industries.

One use of EBIT is as a measure of financial performance. In particular, EBIT can be used to compare the profitability of companies in different industries or sectors. This is because EBIT removes the impact of financing decisions and tax rates from the equation. As such, it can provide a more accurate comparison than measures that include these factors.

Another use of EBIT is as a tool for decision-making.

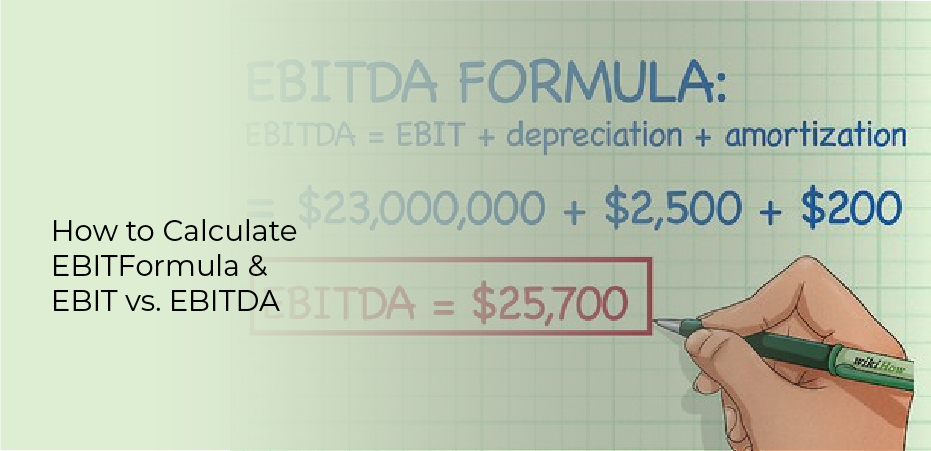

EBIT vs. EBITDA

The two most common financial metrics used in business are earnings before interest and taxes (EBIT) and earnings before interest, taxes, depreciation, and amortization (EBITDA). While they both measure a company’s profitability, there are some key differences between the two.

EBIT is simply a company’s earnings before interest and taxes are paid. This metric measures how much profit a company made on its operations, excluding any interest payments or tax expenses.

EBITDA, on the other hand, includes not only a company’s earnings before interest and taxes, but also its depreciation and amortization expenses. This metric provides a more complete picture of a company’s profitability, as it takes into account the impact of non-cash expenses on a company’s bottom line.