How To Find Marginal Revenue? Finding marginal revenue is important for business owners and managers. It can help them make pricing decisions and understand how their businesses are doing. In order to find marginal revenue, business owners and managers need to know the total revenue and the marginal cost of producing an additional unit of a good or service. Once they have these figures, they can divide the marginal cost by the marginal revenue to find the profit-maximizing price.

Many businesses use marginal revenue to set prices for their goods and services. However, it is important to note that not all businesses should use this pricing strategy. For example, companies with high fixed costs or companies in industries with intense competition should not rely on marginal revenue to set prices.

Overall, finding marginal revenue can be helpful for businesses looking to make more money while still providing quality goods and services.

What is marginal revenue?

Marginal revenue is the change in total revenue that results from a one-unit change in the quantity of a good or service sold. It is calculated by dividing the change in total revenue by the change in quantity. Marginal revenue is always positive, since total revenue always increases when more units are sold.

The greater the quantity of a good or service that is sold, the lower the marginal revenue per unit. This is because fixed costs are spread over more units, resulting in a lower average cost per unit.

Marginal revenue and other economic metrics

Marginal revenue is a metric used in economics to measure the change in revenue generated by selling one more unit of a good or service. It is calculated by dividing the change in total revenue by the change in quantity sold. Marginal revenue can be used to calculate the optimal quantity to produce, as it represents the additional income generated by selling one more unit.

Other economic metrics that can be used to optimize production include marginal cost and average revenue. Marginal cost measures the increase in costs associated with producing one more unit, while average revenue measures the average amount of money generated per unit sold. When combined with marginal revenue, these metrics can help businesses determine whether it is more profitable to produce more or fewer units.

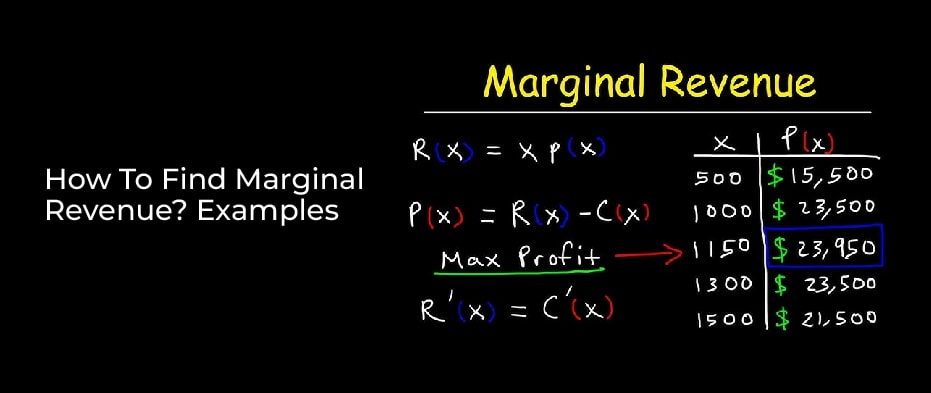

Calculating marginal revenue

Marginal revenue is the change in total revenue that results from a change in the quantity of a good or service sold. It can be calculated by dividing the change in total revenue by the change in quantity. Marginal revenue is important to business owners because it helps them determine how much they should produce and sell in order to maximize their profits.

Many businesses use marginal revenue analysis to make pricing decisions. When the price of a good or service is increased, marginal revenue usually decreases. This is because as prices increase, consumers are less likely to buy additional units of the good or service. Businesses must then weigh the decrease in marginal revenue against the increase in total revenue to determine whether or not raising prices is beneficial.

When the price of a good or service is decreased, marginal revenue usually increases.

Examples of marginal revenue

Marginal revenue is the increase in total revenue that results from producing one more unit of a good or service. It is calculated by dividing the change in total revenue by the change in quantity produced. Marginal revenue can be either positive or negative, depending on how the quantity produced affects total revenue.

One example of marginal revenue is a company that sells t-shirts. If the company produces an additional t-shirt, and the total number of t-shirts sold increases as a result, then the marginal revenue for producing that shirt is positive. However, if producing an extra t-shirt causes sales to decrease, then the marginal revenue for producing that shirt is negative.

Another example of marginal revenue can be seen in a grocery store.

Why does your business need to calculate marginal revenue?

In order to be successful, a business needs to know how to calculate marginal revenue. Marginal revenue is the change in total revenue that results from producing one more unit of a good or service. This calculation is important because it can help businesses determine whether or not it is profitable to produce an additional unit of a good or service.

For example, if a business produces widgets and the total cost of producing an additional widget is $10, while the additional revenue generated by selling that widget is only $8, then the business would be losing money on each additional widget sold. In this case, it would not be profitable for the business to produce any more widgets.