The Degree of Operating Leverage (DOL) is a measure of a company’s financial risk. The higher the DOL, the more risky the company’s operations are. This is because a high DOL means that a company is highly leveraged and therefore more vulnerable to swings in profits.

There are several factors that can affect a company’s DOL. The most important factor is the amount of debt a company has compared to its equity. Other factors include the variability of a company’s sales and costs, and the mix of products and services it sells.

A high DOL can be both good and bad for a company. On one hand, it can mean that a company is able to borrow money at low interest rates, which can boost profits.

High Operating Leverage

There are a variety of benefits that come with high operating leverage. The most obvious benefit is that it can lead to higher profits. When a company has high operating leverage, it means that it is using a lot of its fixed costs in order to produce its goods or services. This can lead to more volatility in the company’s earnings, but it can also lead to larger profits when things are going well.

Another benefit of high operating leverage is that it can make a company more resistant to downturns in the economy. When sales decline, a company with high operating leverage will be hit harder than one with low operating leverage, but it will also be more likely to rebound quickly when the economy picks up again. This is because the company will have less fixed costs and can quickly adjust its production levels to meet demand.

Finally, high operating leverage can give companies a competitive advantage.

Low Operating Leverage

Low Operating Leverage is a term used to describe a company that has a low amount of debt in comparison to its equity. This allows the company to have more financial flexibility and makes it less risky for investors. Because the company isn’t as leveraged, it doesn’t have as much to lose if its profits decline.

This can make the company’s stock more attractive to investors. Low Operating Leverage can also be a sign of a healthy business since it indicates that the company is generating enough cash flow to sustain itself without borrowing money.

How to Use Operating Leverage

- Operating leverage is a measure of a company’s financial risk that is derived from its use of debt.

2. It is calculated by dividing a company’s operating income by its net income.

3. A high operating leverage ratio indicates that a company is highly leveraged and therefore more risky.

4. A low operating leverage ratio indicates that a company is not highly leveraged and is therefore less risky.

5. Operating leverage can be used to increase profits in good times and protect them in bad times.

6. Companies should carefully weigh the risks and benefits of using operating leverage before making any decisions.

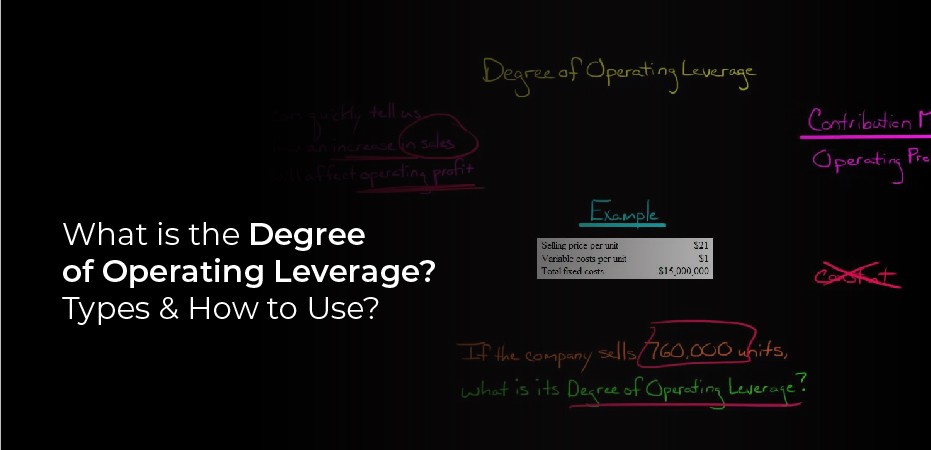

Breaking Down Degree of Operating Leverage

Degree of Operating Leverage (DOL) is a calculation that tells you how much a company’s operating income changes in relation to the percentage change in sales. A high DOL means that a company’s profits are more sensitive to changes in sales, while a low DOL means that profits are less sensitive.

There are a few things you should keep in mind when looking at a company’s DOL. The first is that a high DOL doesn’t necessarily mean that the company is doing well. It could just mean that the company is very risky and susceptible to swings in the economy. The second thing to keep in mind is that DOL can vary from industry to industry. For example, companies in the technology industry tend to have high DOLs because their products are constantly changing and evolving.

Example of Operating Leverage

Operating leverage is a term used in business to describe the degree of a company’s reliance on debt financing. Operating leverage is also known as financial leverage. It is calculated by dividing a company’s total liabilities by its equity. The higher the number, the more debt financing a company has and the more volatile its earnings will be.

An example of operating leverage can be seen in the airline industry. Airlines tend to have high levels of debt financing, which makes their earnings more volatile than other industries. When fuel prices rise, airlines have to pay more for their fuel, but they don’t earn any more money from passengers. This can lead to large losses for airlines when fuel prices increase.