The return on sales ratio is a reliable way to measure a business’s performance quarterly or yearly. It is an important metric for companies because rising sales can increase costs and lower net profit. The ROS ratio helps business owners understand the relationship between expenses and revenues and how to best use resources.

It can be calculated using various methods. This article will cover how to calculate your return onsales and discuss some of the limitations of ROS ratios. We’ll also discuss when to use the ROS ratio and when to avoid it.

How To Use & Calculate Return on Sales(ROS)

ROS is a critical metric for investors and business analysts. It is a way to measure the profitability of a company’s operations and is useful for comparing companies in the same industry. Of course, ROS ratios differ among businesses with different business models. However, businesses should benchmark their ROS against similar companies in the same industry To ensure an accurate comparison.

When people calculate a ROS, they need to divide total sales by expenses. After deducting costs, the return onsales will show how much profit you have generated from sales. The higher the number, the better.

The return onsales is particularly useful for analysing trends over a long period. For example, if profits decline during a certain period, it may be a sign that your company is taking advantage of less profitable sales opportunities. It could also indicate over-saturation in a lucrative market, affecting your company’s profitability.

Depending on your industry and size, a good ROS ratio is around five to ten percent. To maximize your return onsales, you should look at increasing your revenue while lowering costs. You can also lower your expenses by negotiating lower prices and analysing your production.

Limitations Of Return on Sales Ratio

One of the main limitations of the ROS ratio is that it is based on historical figures. This means that it will not be useful if the business has changed its business model or entered a new line of business. Another limitation of this metric is that it doesn’t affect the inflation factor. For example, a company’s revenues may increase in one year, but in a later quarter, the revenue will fall due to inflation.

The return on sales ratio is useful for comparing companies within the same industry. However, the definition of a good return onsales varies depending on the industry, so comparing companies in the same industry or having similar business models is essential. A return onsales ratio that is too low or too high indicates that a company is headed for financial trouble. The ROS should be used together with other financial ratios to evaluate a company’s efficiency and profitability.

An increasing ROS indicates that a company is improving its operational efficiency, while a falling ROS may indicate a looming financial crisis. ROS is also related to operating profit margin, which measures how profitable a business is relative to its total sales.

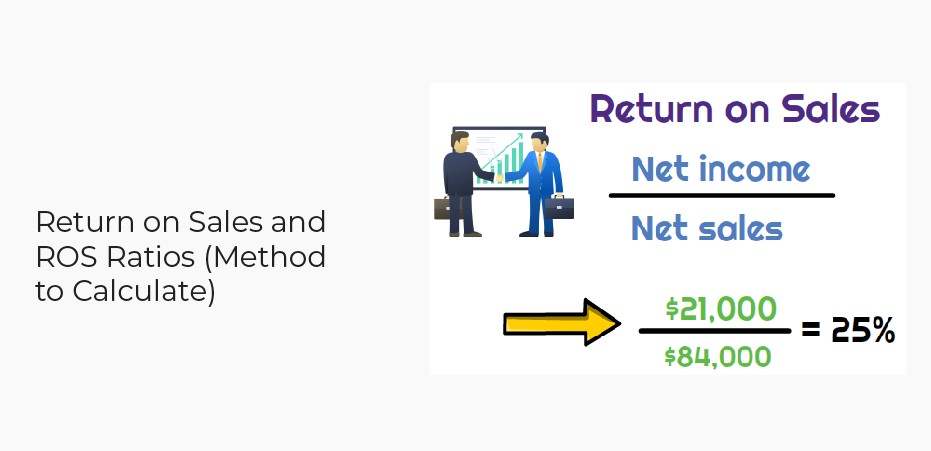

How to Calculate Return on Sales Ratio

Formula = Operating Profit ÷ Net Sales = company’s return on the sales ratio

The ROS ratio is an important financial ratio for businesses. It measures how profitable a business is by dividing the operating profit by the sales. This number is then expressed as a percentage. A high ROS ratio means a business is profitable and efficient. In this example, a company earning $150,000 in net sales has a thirty percent ROS ratio.

This metric shows how efficiently the company is managing its revenues and expenses. It’s important for all businesses because it provides transparency and helps businesses make decisions about growth. It also helps investors evaluate the business’s profitability and indicates when a business is experiencing financial difficulties.

The ROS can be used to compare Fortune 500 companies to smaller companies or regional firms. It is a simple calculation that measures efficiency without considering non-operating expenses such as wages.

Final Words

The return on sales (ROS) is a great metric for understanding how well a product or service performs. We can use this tool to understand how successful an article has been. The more article we have on the platform, the easier it is to determine how successful they are.

There are 3 different ways to calculate the ROS. They all use a similar formula: ROS = (Revenue – Cost)/Cost. You will need to be aware of some things when calculating the return onsales: The price of the item being sold, Cost of goods sold, revenue from the sale, etc.