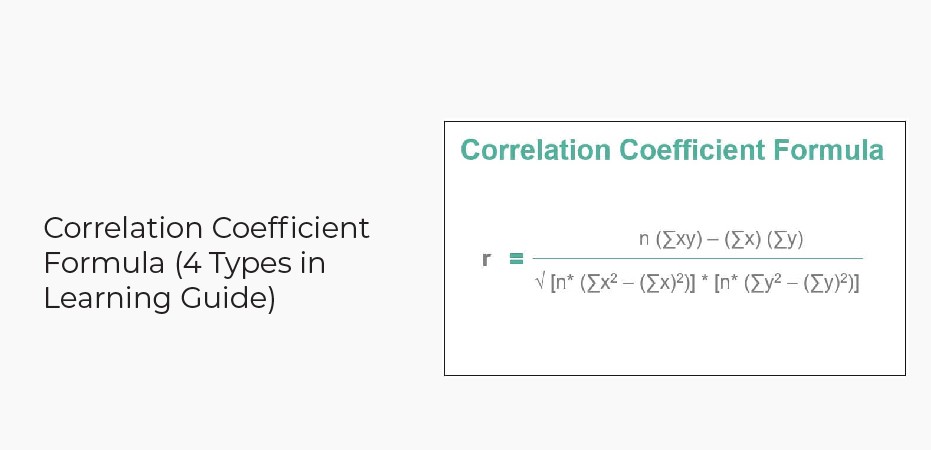

The correlation coefficient formula is a statistical measure of the degree to which two variables move in the same direction. The coefficient ranges from – 1 to + 1, where 1 indicates a perfect positive correlation and 0 indicates no correlation. This article will review the basics of the correlation coefficient and how to interpret it. Let’s start by considering a simple example. Suppose you have two data sets, one with x values (e.g., temperature) and another with y values (e.g., rainfall).

Then, the correlation coefficient between the two variables is simply the ratio of the product of the corresponding pairs of values to the sum of the products of the pairs. For example, if you compute the correlation coefficient between the temperature and rainfall data sets, you would take the product of each pair of corresponding values in the data set and divide that by the sum of all such products.

4 Types of Correlation Coefficient Formula

1. Tableau Correlation Co-Efficient Formula

If you are a data-driven marketer, you should know how to create a visual representation of the correlation coefficient. This formula allows you to analyse relationships between two variables. It also allows you to highlight legends, trend lines, and other statistics on your charts. These statistics help you understand your data better.

You can use this formula to calculate the correlation between two variables in Tableau. Tableau will aggregate your data before sending it to TabPy. You will then receive the correlation coefficient from TabPy. Once you have a correlation coefficient, you can plot it using the scatterplot tool. If you don’t want to use the scatter plot option in Tableau, you can use the least squares method instead.

This method is simple but can be tedious. Luckily, there are software tools available that make this process quick and easy. A correlation coefficient formula is easy to calculate using the CORREL function in Excel.

2. Pearson Correlation

The Pearson correlation coefficient, or “r,” measures the linear correlation between two data sets. Other names for this statistic include Pearson product-moment correlation coefficient, bivariate correlation, and bivariate correlation coefficient. It measures the degree of similarity between two data sets and can be used to compare the statistical significance of two data sets.

The Pearson r correlation coefficient does not prove that the two variables are causally related. Rather, the correlation coefficient indicates that two variables are correlated but not necessarily related. A spurious correlation, on the other hand, suggests causation.

3. Spearman’s Rank Correlation Formula

Spearman’s rank correlation coefficient formula can help you to estimate a relationship between two variables. Typically denoted with the Greek letter rho, the coefficient is a nonparametric measure of rank correlation. It assesses the relationship between two variables based on their rank and can be calculated using a monotonic function.

To calculate Spearman’s rank correlation coefficient, you need to know which variables are correlated. Firstly, you need to know how many data pairs are compared. You can determine how many by dividing the two variables by their ranks. After you know how many data pairs you have, you need to find their differences to calculate Spearman’s rank correlation co-efficient formula.

Secondly, the coefficient of correlation assumes that the variables are measurable. For example, a singing competition may require the judges to rank the contestants based on their performance. Similarly, students may be ranked based on the answers they give. If the scores of both variables are high, Spearman’s rank correlation coefficient will be high.

4. Positive Correlation Coefficient

The Positive correlation coefficient formula measures the relationship between two variables. It helps investors determine if a security is negatively or positively correlated with another. The formula can also show which investments are likely to increase in price while others decline in value. It can also show the effect of external factors on the price of a particular stock.

However, the Pearson correlation coefficient is the inverse of the negative correlation coefficient and can range from +1 to -1. While this correlation coefficient can help determine the relationship between two variables, it’s not sufficient to determine if they are related.

A simple method is to use a graphing calculator to perform the calculation. The CORREL function in Excel is probably the easiest method to use. For example, if John is analyzing data on the 500 Index and the stock market of Apple Inc., he’ll use the CORREL function to determine the correlation between these two stocks.

Final Words

The correlation co-efficient formula depends on the type of data you are measuring. If you are measuring a continuous variable like IQ and want to find out if there is any correlation between IQ and height, then you use the Pearson Correlation Co-Efficient Formula. If you are measuring a categorical variable like sex or favorite color and want to see if there is any difference between these two variables, then use the Chi-Square Test.

For the Pearson Correlation Coefficient, if you have more than 2 variables (i.e., 3 or more), you will need to transform your data into a table of frequencies. For example, for an IQ test, you can find out the number of people who got a score of 100, 120, etc. You can then convert this into percentages and calculate the correlation coefficient using the following formula: where _x_ and _y_ are the numbers of people in each category.