Considering a new investment opportunity, consider using Levered Free Cash Flow (LFCF) to determine its profitability. This simple tool can simplify your investment strategy. It is also a great way to understand your business’s cash flow projections better. A large difference between LCF and LFCF indicates a healthy budget and flexibility to take on new projects. Levered Free Money Flow is a powerful tool for small and growing businesses.

Introduction of Levered Free Cash Flow (LFCF)

LFCF is a key metric for investors because it is the most reliable indicator of how well a company manages its cash. LFCF measures the company’s ability to generate cash from operations minus capital expenditures. The idea behind levered free Money flow is simple. A company generates cash by operating its business and selling its products or services. However, this cash is not available to the company unless it invests in new equipment, hires more workers, buys supplies, etc.

What Do You Know About Unlevered Free Cash Flow

If you want to know whether a company is financially healthy, you must first understand how unlevered free cash flow is calculated. This measure shows a company’s final cash flow after all debts and expenses are removed. It is used with DCF, private equity, and corporate finance. It can be used to forecast a company’s cash flow reliably.

Unlevered free cash flow is the amount of cash a firm generates before adjusting for expenses, debt servicing, and fixed asset purchases. Unlevered free cash flow can determine how much of a company’s debt can be paid without exceeding its equity stake. Comparing a company’s cash flow with its industry peers is also useful.

How to Calculate UFCF

FFCF is a critical measure for evaluating a company’s financial condition. It represents the cash a company would have left over after paying all its debts, including interest. It can also help determine a company’s enterprise value, showing how much cash is available before debts are paid.

Although UFCF is not a straightforward number, it is important to understand what it means for your company’s future profitability. A higher UFCF means the company can spend more on operations, fund future growth strategies, and pay off debt principal. But that doesn’t mean it’s bad. It’s important to understand what’s behind the numbers and note trends over time.

Unlevered free cash flow is generated when debt repayment costs are zero. It is calculated by subtracting taxes from EBIT and depreciation from amortization. It also includes capital expenditures and is easy to calculate and is crucial for determining an enterprise’s value.

What do You Know About Levered Free Cash Flow

Simple free cash flow, also called free cash flow to the firm, measures the amount of cash a company has left over after deducting its debt and expenses. This cash flow is a key measure for companies as it indicates their ability to grow and pay dividends to their shareholders. This cash flow is very important, particularly for small businesses, as they typically pay operating expenses and dividends in cash.

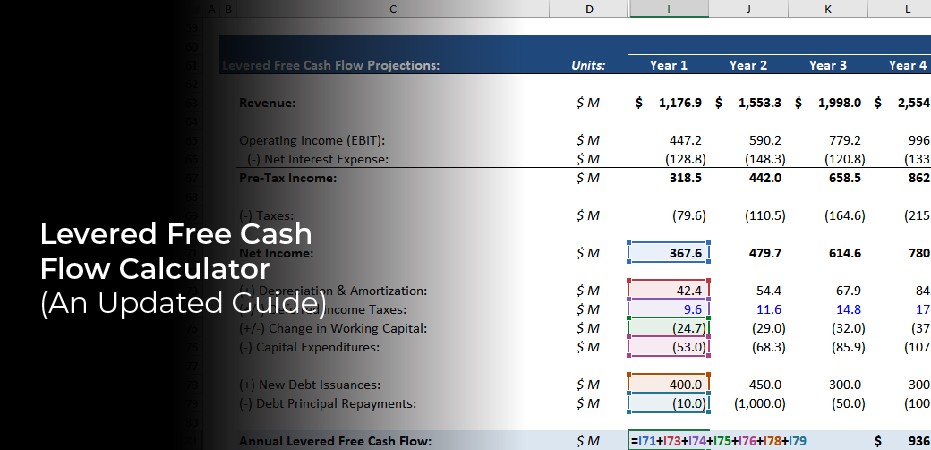

LFCF can be calculated using EBITDA, net income, and working capital. After deducting debt and taxes, free cash flow represents the cash available to pay debtholders and shareholders. Levered free cash flow is considered a better measure of a company’s profitability than the simpler free Money flow calculation.

A company with a positive LFCF is a low-risk borrower and better positioned to attract additional funding. In addition, a company with a negative LFCF may have incurred significant capital investments.

On the other hand, operating cash flow starts with net income and adds depreciation and amortization expenses to current assets. Moreover, it also takes into account changes in inventory and accounts payable. It is important to note that the net cash flow is inflated by net debt issuance.

How to Calculate LFCF

When calculating Levered Free Cash Flow, it is important to note that this analysis is more complex than the Unlevered version. This variation requires significant changes to every part of the analysis. Because of the added work, the results of Levered FCF are not always as consistent as those of Unlevered DCF.

A business with excess free cash flow can use it for many purposes, including expanding, paying down debt, or paying additional dividends to its investors. While calculating free cash flow alone may not be an essential part of financial analysis, it can be helpful for businesses with significant capital investments and those that want to maximize their cash flow.

Levered FCF yield is calculated by dividing FCF by the current share price. In the example above, the FCFE is $10mm. The value of the shares is $200mm. The equity value must be used in the denominator to reflect the equity holders. Therefore, the levered FCF yield equals 5.1%. Levered FCF yield reflects the residual free cash flow for equity holders.

Final Verdict

Lenders need to focus on customers first and foremost. They are in the business of helping people, which comes across in their customer service. Lenders should offer great customer service. This is not always easy when you are operating under tight restrictions.

But they must work to be more customer-focused, which means being a little less restrictive. For example, they can give up the right to deny an application for a loan because of an applicant’s credit score. Lenders must also focus on giving better communication. A lender not listening to their customers can be in trouble.