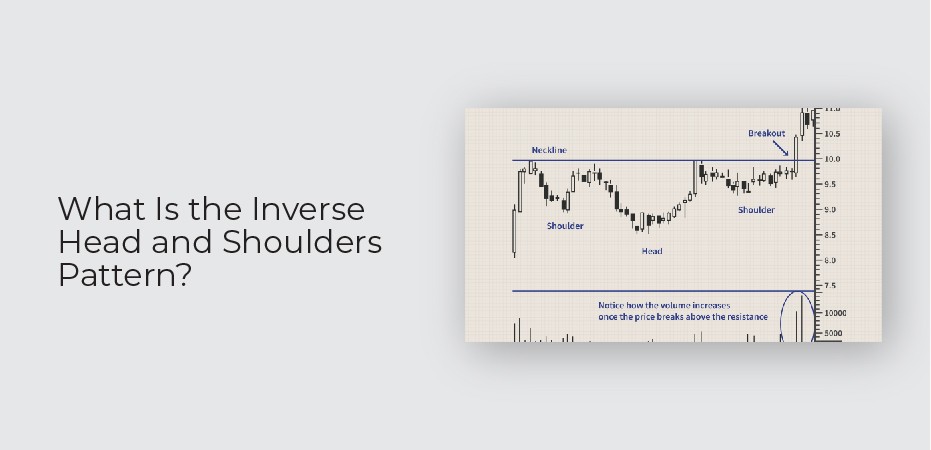

The inverse head and shoulders is a technical analysis pattern that signals a reversal in the trend. The pattern is formed when the price of a security falls to a new low, rises above the previous high, and then falls again to create a shoulder.

The security then rallies to a higher high, breaking above the neckline of the pattern. This signals that the downtrend has reversed and that there is potential for an upside move.

What Does an Inverse Head and Shoulders Tell You?

An inverse head and shoulders is a bullish reversal pattern that forms at the end of a downtrend. It is made up of three candlesticks: a long black candlestick, followed by two white candlesticks, with the second white candlestick being the smallest.

The inverse head and shoulders tells you that the downtrend has ended and that a new uptrend is likely to occur.

Identifying the Inverse Head and Shoulders

The inverse head and shoulders is a reversal pattern that can be used to identify potential turning points in a market.

The pattern is formed when the market reaches a high, the price falls, rises again to form a second high that is lower than the first, and then falls once more. This final fall confirms the reversal and often marks a major bottom in the market.

Trading an Inverse Head and Shoulders Aggressively

Inverse head and shoulders is one of the most commonly traded patterns in technical analysis. Most traders use this pattern to enter into a long position, expecting the price to rise. However, there is also an opportunity to trade an inverse head and shoulders aggressively by shorting the stock once the pattern is identified.

The key to trading this pattern aggressively is waiting for confirmation of the breakout before taking a short position. This can be done by looking for a close below the neckline or by waiting for volume to increase on a breakdown below the neckline. Once confirmed, it is important to have a tight stop loss in place in case of a reversal.

If you are able to time your entry correctly, an inverse head and shoulders can be a very profitable trade.

Trading an Inverse Head and Shoulders Conservatively

Inverse head and shoulders is a technical analysis pattern that can be used to predict a reversal in the price of a security. The pattern is formed when the price of a security falls to a new low, rises above the previous high, falls back below the previous high, and finally rises above the original high.

Traders can use inverse head and shoulders to identify potential entry and exit points for a trade. For example, if a trader believes that the security is likely to reverse direction after forming an inverse head and shoulders pattern, they may want to enter into a long position once the security breaks above the neckline of the pattern.

Conversely, if the trader believes that the security will continue to fall after forming an inverse head and shoulders pattern, they may want to enter into a short position as soon as the security breaks below the neckline.

The Difference Between an Inverse Head and Shoulders and a Head and Shoulders

The inverse head and shoulders and the head and shoulders are two of the most commonly occurring formations in technical analysis. They are both formations that suggest a reversal in the trend of a security, but they are formed in different ways and have different implications.

An inverse head and shoulders is formed when the security falls to a new low, then recovers before falling again to a new low that is lower than the first. The recovery between these two lows forms the left shoulder, the second low forms the head, and the recovery after that forms the right shoulder. The neckline is drawn across the highs of these three swings.

A head and shoulders is formed when the security falls to a new low, then recovers before falling again to a new low that is higher than the first.

Limitations of an Inverse Head and Shoulders

The inverse head and shoulders pattern is a bullish reversal pattern. The pattern is formed when the price reaches a new low, bounces off of the support level, and then rises to form a right shoulder. The price then falls again to form a left shoulder, and finally breaks above the resistance level to complete the pattern.

The inverse head and shoulders pattern can be used to identify potential buy signals. However, there are several limitations to this pattern. First, the inverse head and shoulders pattern is not always reliable. The pattern may not form in every market conditions, and it may not be accurate in predicting future prices.

Second, the inverse head and shoulders pattern should only be used as a signal for long-term investors. The pattern does not provide short-term trading signals, and it may take several weeks or months for the stock to reach its ultimate price target.